Capital gains tax on second home calculator

Capital gains tax CGT breakdown. Capital gains tax on shares Capital gains tax on shares is charged at 10 or 20 depending on your income tax band.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Married taxpayers filing jointly can.

. This guide shows you how to calculate your bill. Long-term capital gains tax is a tax applied to assets held for more than a year. Our capital gains tax rates guide explains this in more detail.

The capital gains tax property six-year rule see below. The large capital gains tax reduction for long-term investments is one of the reasons many people tend to favor the buy-and-hold approach. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total.

If the above is correct you only pay capital gains on 50 of that and at the tax bracket applicable to your total income for the year. So 50 of 435k 2175k 33 71775 in taxes. The second option is to opt for the former treatment whereby gains are taxed at 172 for social contributions and if the instrument has been held for at least two years 60 of the gains are taxed as individual revenue tax scale between 045.

The first one is main residence exemption. There is a capital gains tax on sale of home and property. For instance if someone in the 35 tax bracket invests 100000 in a stock and sells it six months later for 160000 they make a.

More help with capital gains calculations and tax rates. Multiple ways are available to. We also need to apply the capital gains inclusion rate of 40 per individual.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. -If you sell a personal asset such as your home or car for a gain that gain is usually taxable unless you qualify for a specific exemption. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty.

Capital gains tax CGT is payable on the sale of second homes and buy-to-let property. Find out how much CGT youll pay. As you may have guessed short-term capital gains tax rates tend to be a bit higher than long-term rates for people with the same income levels and.

Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR. If you are in the 10 percent or 15 percent tax bracket your long-term capital gains tax rate is 0 percent. So house flippers and real estate investors are more likely to pay short-term capital gains tax whereas long-term capital gains tax usually applies to homeowners selling a primary residence.

You only owe 1500 in capital gains tax. In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Capital gains tax is the amount of tax owed on the profit aka the capital gain you make on an investment or asset when you sell it.

It is calculated by subtracting the assets original cost or. Assume that the annual marginal rate of tax on income is 41 which is applied to the R424 000 then the capital gains tax will be R173 840. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real.

Unmarried individuals can exclude up to 250000 in profits from capital gains tax when they sell their primary personal residence thanks to a home sales exclusion provided for by the Internal Revenue Code IRC. Tax loss harvesting mentioned above refers to selling securities but capital assets also include your home car furniture jewelry etc as well as your financial assets. You pay 127 at 10 tax rate for the next 1270 of your capital gains.

The taxable gain as per the calculation above on the primary residence must be included. Home equity line of credit HELOC calculator. The capital gains tax is economically senseless.

There are several ways in which you can avoid capital gains tax. Any capital gain mais-valia. Weve got all the 2021 and 2022 capital gains tax rates in one.

You pay no CGT on the first 12300 that you make. In your case where capital gains from shares were 20000 and your total annual earnings were 69000. If you are in the 25 percent tax bracket for example your tax rate on long-term capital gains is only 15 percent.

Iqexxkzshldbom

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Capital Gains Tax Calculator 2022 Casaplorer

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Solved Can You Avoid Capital Gains Taxes On A Second Home

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Tax Calculator Capital Gains Tax Cgt When Selling A Buy To Let Property Youtube

How To Calculate Capital Gains Tax H R Block

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Calculator The Turbotax Blog

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Property Tax Calculator Deals 53 Off Www Al Anon Be

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Capital Gain Tax Calculator 2022 2021

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

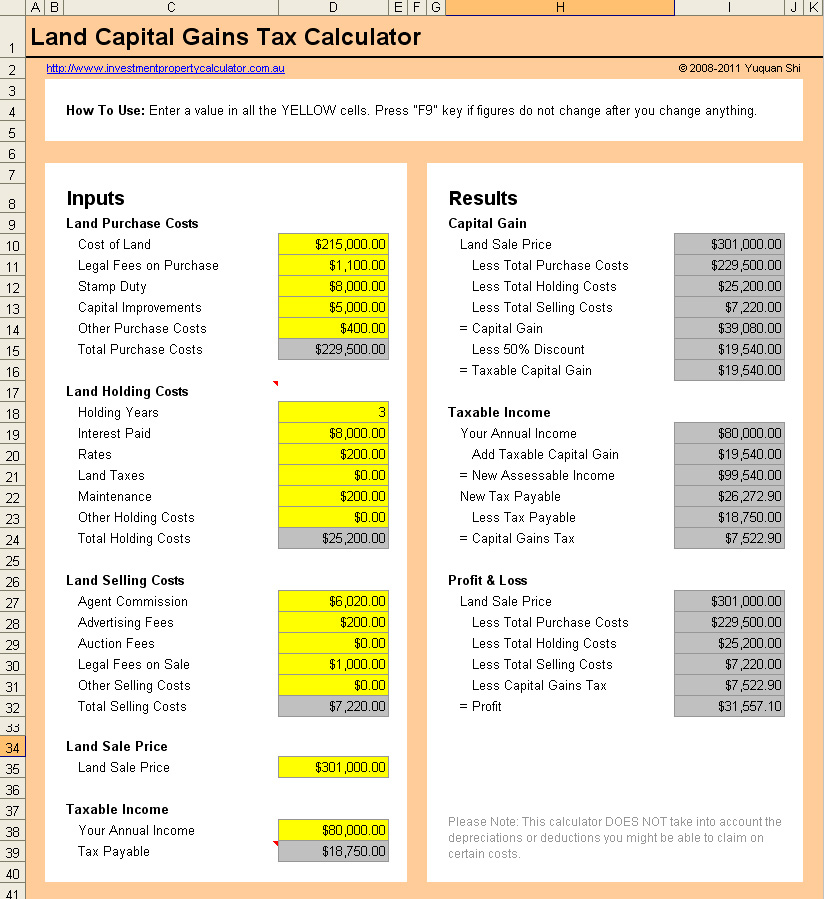

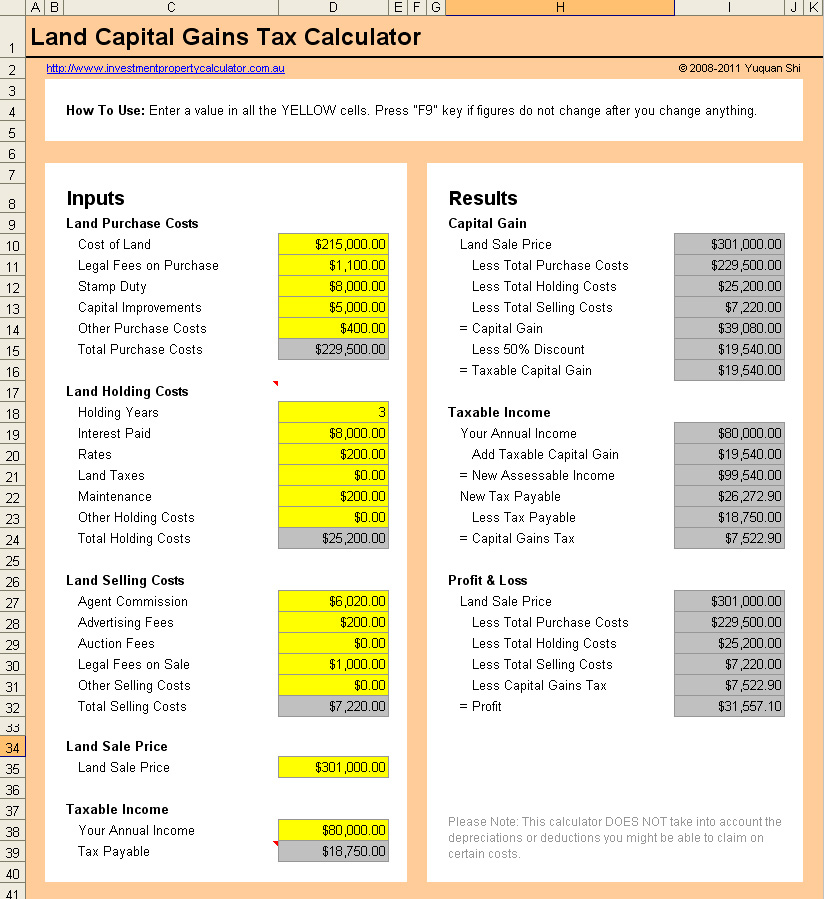

How Do I Calculate Capital Gains On The Sale Of My Home